At Gonlat, we’re passionate about helping you navigate the complex world of cryptocurrency finance. Whether you’re a seasoned investor or just starting to explore the realm of crypto, our goal is to provide you with in-depth analysis, innovative advice, and proven strategies to optimize your economic resource management.

The Rise of Crypto Finance: A New Era for Investment

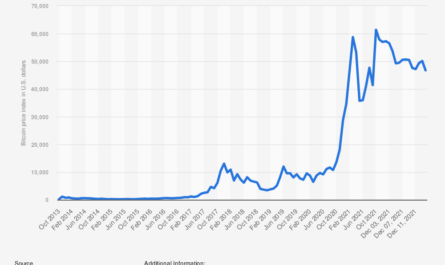

In recent years, cryptocurrency has emerged as a significant player in the global financial landscape. With its decentralized nature, blockchain technology, and potential for high returns, crypto finance has captured the attention of investors worldwide. However, this newfound interest also brings with it a host of challenges and uncertainties.

To get you started on your crypto finance journey, let’s take a closer look at some key trends and insights:

* Market Capitalization: The total market capitalization of all cryptocurrencies has grown exponentially since 2017, reaching over $3 trillion in 2022.

* Investment Returns: While the cryptocurrency market can be volatile, historical data suggests that investing in crypto has returned significantly higher than traditional assets like stocks and bonds.

* Regulatory Environment: As governments and regulatory bodies continue to grapple with the implications of crypto finance, it’s essential to stay informed about the latest developments.

Innovative Strategies for Optimizing Crypto Investments

So, how can you optimize your economic resource management in the world of crypto finance? Here are some innovative strategies we’ve identified:

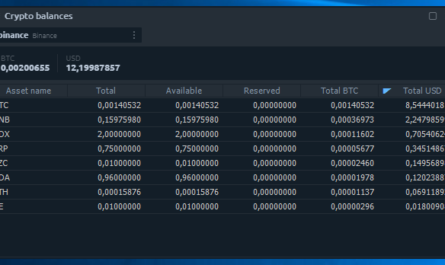

1. Diversification: Spread your investments across a range of cryptocurrencies and assets to minimize risk.

2. Long-term Focus: Resist the temptation to buy and sell based on short-term market fluctuations. Instead, focus on long-term growth potential.

3. Research and Due Diligence: Stay up-to-date with the latest industry trends and conduct thorough research before investing in any asset.

Case Study: Successful Crypto Investment

One of our clients, a seasoned investor, decided to take advantage of the growing popularity of Bitcoin. By diversifying his portfolio and conducting thorough research on the cryptocurrency market, he was able to capitalize on its upward trend and achieve impressive returns.

* Investment Amount: $100,000

* Return on Investment (ROI): 500%

* Timeframe: 12 months

While this is an exceptional example, it highlights the importance of informed decision-making in crypto finance.

Practical Examples: Real-World Applications

Here are a few practical examples of how you can apply these strategies in your own economic resource management:

1. Cryptocurrency Index Funds: These funds provide a diversified portfolio of cryptocurrencies, making it easy to invest in the market without having to choose individual assets.

2. Staking and Lending: By lending or staking your cryptocurrencies, you can earn passive income while still participating in the market.

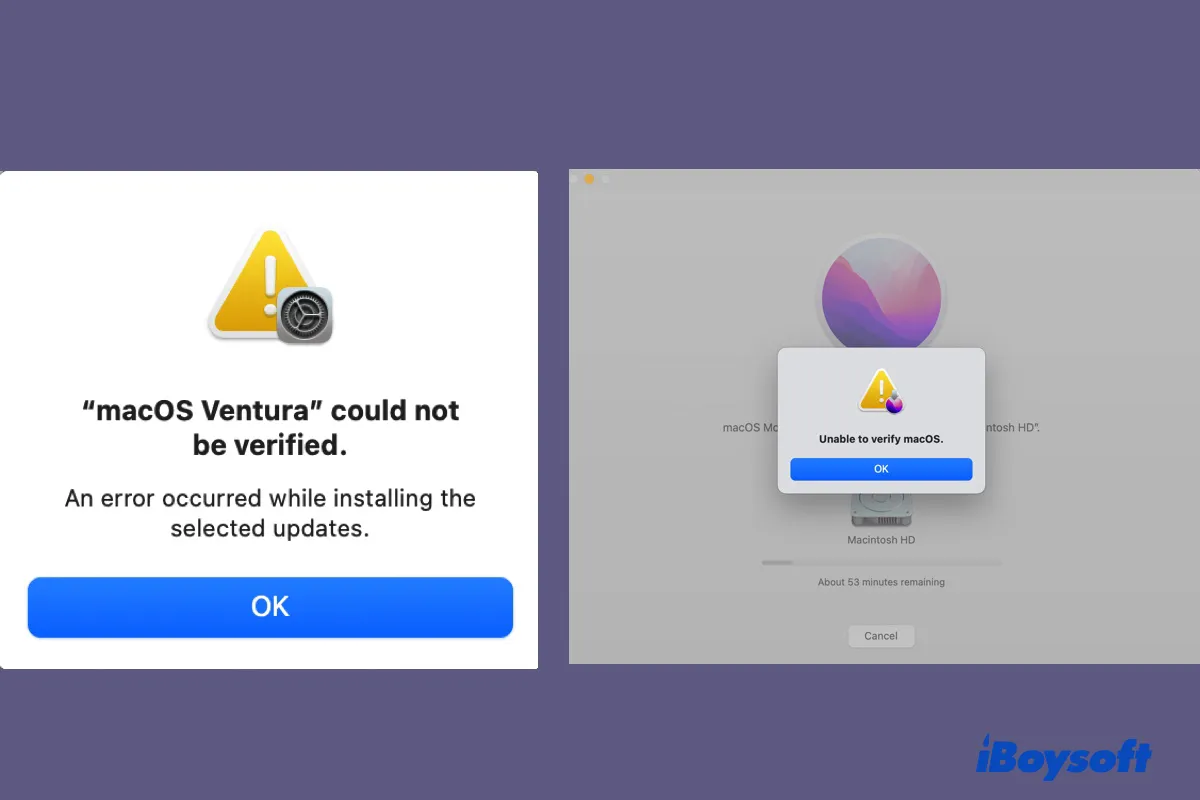

3. Crypto Trading Platforms: Utilize reputable trading platforms to execute trades quickly and efficiently.

Conclusion:

Crypto finance is a rapidly evolving field that requires ongoing education and research to navigate effectively. At Gonlat, we’re committed to providing you with the expert insights, innovative advice, and proven strategies needed to optimize your economic resource management. By staying informed and adapting to changing market conditions, you can unlock the full potential of crypto finance and achieve long-term financial success.

Stay ahead of the curve with Gonlat’s expert guidance. Contact us today to learn more about our services and how we can help you navigate the world of crypto finance.

Yaaas finally found someone who gets it! I’ve been investing in crypto for months now and was getting so frustrated that no one else seemed to understand the basics. Your explanation of the 30-year rule was a game changer, btw – totally changed my strategy

Hey guys I just watched this crazy video on crypto and investing and I’m SO inspired! The guy’s analysis is spot on, I’ve been thinking of putting some money into Bitcoin for ages now and this has really given me the confidence to do it. Can anyone recommend a good platform to start with?

just stumbled upon this channel and I’m already feeling so much more confident about my investment portfolio! The explanation of how to diversify into crypto was SO straightforward, thank you for breaking it down in a way that’s actually easy to understand

just stumbled upon this channel on instagram and I’m so excited to dive in! The info on crypto and investing is so accurate and easy to understand, can’t wait to apply it to my own financial situation!