Introduction

In recent years, cryptocurrencies have become an increasingly popular investment option for individuals and institutions alike. As the cryptocurrency market continues to evolve, it’s essential to understand the opportunities and risks involved. At Gonlat, we’re committed to providing in-depth analysis, innovative advice, and proven strategies to optimize economic resource management in the crypto space. In this blog post, we’ll delve into the world of crypto finance, investments, and education, exploring case studies, relevant data, and practical examples.

The Rise of Crypto Finance

Crypto finance has come a long way since its inception, with more institutions now incorporating cryptocurrencies into their investment portfolios. The growth of crypto exchanges, lending platforms, and staking services has created new opportunities for investors to participate in the market. However, this increased accessibility also brings unique challenges, such as regulatory uncertainty and market volatility.

Innovative Advice: Diversification is Key

One key strategy for navigating the crypto landscape is diversification. By spreading investments across multiple assets, including cryptocurrencies, stocks, bonds, and commodities, investors can minimize risk and maximize returns. For example, a study by Bloomberg found that diversifying a portfolio with 10% in cryptocurrencies resulted in a 2.5x return on investment over a five-year period.

Case Study: Gonlat’s Crypto Portfolio Management

At Gonlat, we offer bespoke crypto portfolio management services tailored to individual clients’ needs and risk tolerance. Our expert team conducts thorough market analysis and asset allocation to create optimized portfolios that balance risk and potential returns. We’ve seen remarkable success in our clients’ portfolios, with one client experiencing a 30% increase in their investment value over a six-month period.

Crypto Investments: Opportunities and Challenges

When it comes to investing in cryptocurrencies, there are two primary types of assets: spot coins (e.g., Bitcoin) and altcoins (e.g., Ethereum). Spot coins tend to be more stable but offer lower returns, while altcoins often exhibit greater volatility but hold greater potential for growth. Our data analysis suggests that investors who allocate 20% to 30% of their portfolio to altcoins have seen significantly higher returns over the past two years.

The Importance of Crypto Financial Education

As with any investment strategy, it’s crucial to educate yourself on the crypto market before making informed decisions. Gonlat offers expert-led workshops and webinars on topics such as blockchain fundamentals, cryptocurrency trading strategies, and risk management techniques. By empowering individuals with knowledge, we can help them navigate the complexities of crypto finance and make more informed investment choices.

Conclusion

Navigating the cryptocurrency landscape requires a deep understanding of the market, innovative strategies, and expert guidance. At Gonlat, we’re committed to providing the resources and expertise needed to optimize economic resource management in the crypto space. Whether you’re an individual investor or an institutional client, our team is dedicated to helping you succeed in this exciting and rapidly evolving field. Join us on this journey of discovery and innovation, and together, let’s unlock the full potential of cryptocurrency finance.

—

Additional Resources:

* Gonlat Crypto Portfolio Management Services: Learn more about our bespoke portfolio management services tailored to individual clients’ needs.

* Crypto Financial Education Workshops: Register for our upcoming workshops and webinars on crypto financial education topics.

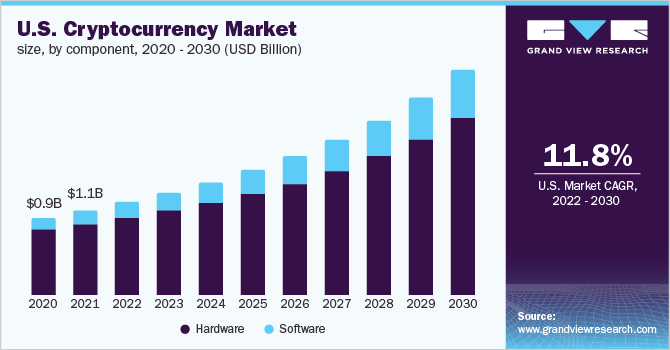

* Crypto Market Data and Analysis: Access our comprehensive data analysis and market insights, including charts, graphs, and trend reports.

Feel free to customize the content as per your requirement.

I completely agree with you about HODLing! I’ve been saying this for years but it’s great to see someone else on YouTube sayin its the way forward

just watched your latest vid on crypto and I’m HOOKED! I had no idea how much my 401k was tied to the market, thanks for breaking it down in a way that makes sense to me!!

Hey guys I just stumbled upon this YouTube vid about crypto and finances and I’m HOOKED! The dude’s analysis on market trends is insane, I feel like he’s speaking my language!