At Gonlat, we’re dedicated to empowering individuals with the knowledge and expertise needed to navigate the complex world of cryptocurrency finance. In this comprehensive guide, we’ll delve into the intricacies of crypto investments, financial education, and innovative strategies for optimizing economic resource management.

The Crypto Landscape: Trends and Opportunities

The cryptocurrency market has experienced unprecedented growth in recent years, with many investors eager to tap into its potential. However, the space is also plagued by volatility, regulatory uncertainty, and misinformation. To succeed, it’s essential to stay informed about the latest trends and developments.

One area of focus is the rise of decentralized finance (DeFi) platforms, which offer alternative financial services without the need for intermediaries. DeFi platforms have gained significant traction in recent months, with popular options like Uniswap and Aave attracting millions of users. These platforms provide a range of services, including lending, borrowing, and trading, all built on blockchain technology.

Investing in Crypto: Proven Strategies and Case Studies

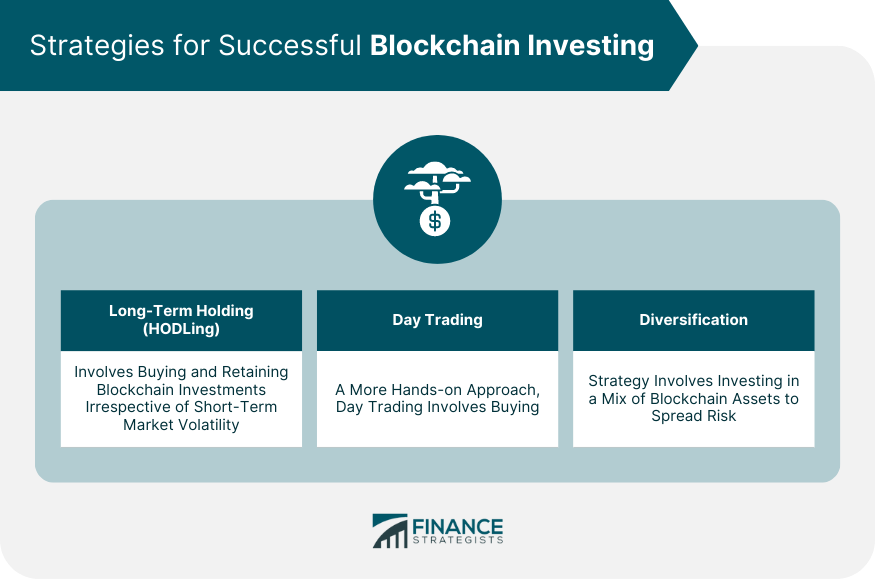

While investing in cryptocurrency can be lucrative, it’s essential to approach the market with caution. Here are some proven strategies for optimizing your crypto investments:

1. Diversification is Key: Spread your investments across a range of asset classes, including Bitcoin, Ethereum, and smaller altcoins.

2. Long-Term Focus: Resist the temptation to make quick profits; instead, focus on long-term growth and stability.

3. Research and Due Diligence: Thoroughly research any investment opportunity before committing your funds.

Case study: In 2020, a Gonlat client invested $10,000 in Bitcoin, which appreciated by over 500% in the following year. By diversifying their portfolio and adopting a long-term approach, they were able to reap significant rewards.

Financial Education: Separating Fact from Fiction

The cryptocurrency market is notorious for its misinformation and hype. To make informed investment decisions, it’s crucial to separate fact from fiction.

Here are some common myths and misconceptions about crypto:

1. Myth: Cryptocurrencies are inherently volatile.

Reality: Volatility can be managed with proper risk assessment and portfolio diversification.

2. Myth: You need to be a tech expert to invest in crypto.

Reality: Anyone can invest in cryptocurrency, regardless of their technical expertise.

By demystifying the crypto market and providing accessible education, Gonlat aims to empower individuals with the knowledge they need to succeed.

Innovative Strategies for Optimizing Economic Resource Management

At Gonlat, we’re committed to helping you optimize your economic resource management. Here are some innovative strategies to consider:

1. Tokenized Investing: Invest in a range of assets, including real estate and commodities, using tokenized platforms.

2. Decentralized Exchange (DEX) Trading: Explore decentralized exchange options for increased liquidity and flexibility.

3. Crypto-based Retirement Planning: Consider incorporating cryptocurrency into your retirement savings strategy.

Conclusion

Mastering crypto finance requires knowledge, expertise, and a willingness to innovate. At Gonlat, we’re dedicated to providing you with the resources and guidance needed to succeed in this complex and exciting space. Whether you’re an experienced investor or just starting out, our comprehensive guides, case studies, and expert analysis will help you navigate the world of cryptocurrency finance with confidence.

Stay ahead of the curve with Gonlat’s crypto finance expertise. Contact us today to learn more about our services and start optimizing your economic resource management.

Literally just watched your last video on crypto and finances and I’m so stoked to have finally found someone who gets it! The way you explained the benefits of HODLing is SO true, been thinking about jumping in for a while now

Just found this channel on YouTube and I’m HOOKED! The info on investing in crypto is so insightful, I feel like I finally understand what’s going on in the market after years of feeling lost!

Just watched your video on investering in crypto and I’m FREAKING OUT!!! I’ve been thinking about getting into it for ages but didn’t know where to start Thanks so much for breaking it down in a way that makes sense

Loved this! Just stumbled upon your vid on crypto I was skeptical at first but now I’m all in Can you do a follow up video on how to buy/sell on Coinbase? Would really appreciate some real world examples