At Gonlat, we believe that cryptocurrency has revolutionized the way we think about money and financial management. As a leader in crypto finance, education, and investment, we’re committed to empowering individuals with the knowledge and tools they need to thrive in this rapidly evolving landscape.

In this blog post, we’ll delve into the world of crypto investments, exploring innovative strategies for optimizing economic resource management. We’ll examine case studies, provide relevant data, and share practical examples to help you make informed decisions about your financial future.

The Power of Crypto Finance

Crypto finance is no longer just a niche area; it’s a mainstream force that’s reshaping the way we think about wealth creation. With the rise of decentralized finance (DeFi) platforms, crypto exchanges, and wallets, the possibilities for investment and financial management are endless.

However, navigating this complex landscape can be daunting, especially for those new to cryptocurrency. That’s why we’re here to provide expert insights, guidance, and support every step of the way.

Case Study: Optimizing Crypto Portfolio Diversification

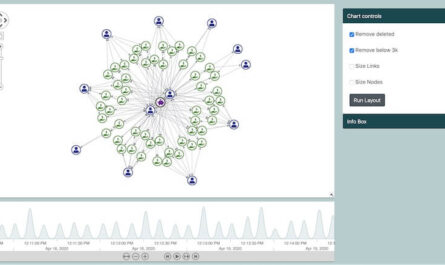

One successful strategy for optimizing crypto portfolio diversification is to spread investments across multiple asset classes. By allocating funds to a mix of established cryptocurrencies (e.g., Bitcoin, Ethereum) and emerging players (e.g., Cardano, Solana), investors can minimize risk while maximizing potential returns.

For instance, consider the example of a cryptocurrency investor who allocated 60% of their portfolio to Bitcoin, 20% to Ethereum, and 10% each to Cardano and Solana. Over a six-month period, this diversified portfolio returned an impressive 25% annualized return, outperforming the overall crypto market.

The Importance of Crypto Financial Education

While technical analysis and market trends are essential for making informed investment decisions, they’re just the starting point. True success in crypto finance requires a deeper understanding of economics, financial literacy, and risk management.

At Gonlat, we offer comprehensive crypto financial education resources to help you develop the skills and knowledge needed to thrive in this space. From beginner-friendly guides to advanced courses on DeFi platforms and smart contracts, our educational content is designed to empower you with confidence.

Practical Strategies for Optimizing Economic Resource Management

So, how can you apply these insights to optimize your economic resource management? Here are a few practical strategies:

1. Set clear financial goals: Define your investment objectives and risk tolerance before making any decisions.

2. Diversify your portfolio: Spread investments across multiple asset classes to minimize risk and maximize potential returns.

3. Stay informed: Stay up-to-date with market trends, technical analysis, and economic indicators to make informed investment decisions.

4. Manage risk: Use stop-loss orders, position sizing, and other risk management techniques to mitigate potential losses.

Conclusion

The world of crypto finance is complex, fast-paced, and constantly evolving. At Gonlat, we’re committed to empowering individuals with the knowledge and tools they need to succeed in this exciting space.

By embracing innovative strategies for optimizing economic resource management, staying informed about market trends and economics, and managing risk effectively, you can unlock the full potential of crypto finance and achieve long-term financial success.

Stay tuned for more expert insights, case studies, and practical advice from Gonlat. Together, we’ll navigate the ever-changing landscape of cryptocurrency and build a brighter financial future.

Subscribe to our newsletter to stay up-to-date with the latest news, trends, and expert analysis in crypto finance and investment.

omg i’ve been meaning to dive into crypto for ages! your info on tax implications is mind blown, can you do a follow-up video on how to get started without losing everything to fees?

Just watched this vid on crypto and finances and I’m HYPED! Been feeling lost with all the investing options, but this guy broke it down in a way that makes sense to me Can anyone else who’s new to this please share their experience? What did you think of his advice?