At Gonlat, we believe that cryptocurrency has revolutionized the way we think about finance and investments. With the ever-changing landscape of crypto markets, it’s essential to stay informed and adapt your strategy to maximize returns. In this blog post, we’ll delve into the world of crypto finance, exploring in-depth analysis, innovative advice, and proven strategies to optimize your economic resource management.

The Evolution of Crypto Finance: A Decade of Growth

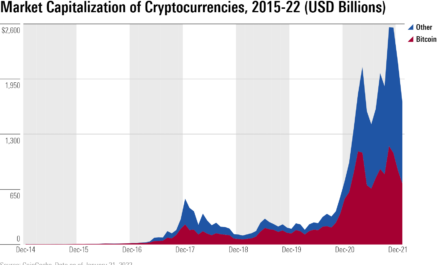

Since its inception, cryptocurrency has come a long way, transforming from a fringe concept to a mainstream phenomenon. Today, the global crypto market capitalization exceeds $2 trillion, with over 5,000 digital assets vying for attention. As the market continues to mature, investors and financial institutions are taking notice.

Case Study: The Rise of DeFi

Decentralized finance (DeFi) has emerged as a significant player in the crypto space, offering innovative solutions for lending, borrowing, and yield farming. Platforms like Uniswap and Aave have attracted millions of users, generating substantial returns for investors who participate in these ecosystems.

Key Metrics: Understanding Crypto Market Trends

To navigate the complexities of crypto finance, it’s crucial to stay informed about market trends and sentiment analysis. Here are a few key metrics to keep an eye on:

* Market capitalization: The total value of all cryptocurrencies in existence.

* Trading volume: The amount of cryptocurrency being traded on exchanges.

* Exchange rate volatility: The fluctuation in the value of one cryptocurrency relative to another.

Innovative Strategies for Crypto Investors

1. Diversification is key: Spread your investments across different asset classes, including stocks, bonds, and real estate.

2. Long-term focus: Avoid making impulsive decisions based on short-term market fluctuations.

3. Leverage technology: Utilize DeFi platforms to optimize returns and minimize risks.

Proven Strategies for Optimizing Economic Resource Management

1. Tax optimization: Take advantage of tax incentives offered by governments and regulatory bodies.

2. Risk management: Implement a comprehensive risk management plan to mitigate potential losses.

3. Dollar-cost averaging: Invest a fixed amount of money at regular intervals, regardless of market conditions.

Practical Examples: Real-World Applications

1. Investing in altcoins: Allocate a portion of your portfolio to lesser-known cryptocurrencies with high growth potential.

2. Using stablecoins: Leverage the stability of fiat currencies by investing in stablecoins like USDT or USDC.

3. Participating in IEOs: Invest in initial exchange offerings (IEOs) to tap into emerging projects and technologies.

Conclusion

Cryptocurrency finance has come a long way, offering numerous opportunities for investors and financial institutions alike. By staying informed about market trends and sentiment analysis, diversifying your portfolio, and utilizing innovative strategies, you can optimize your economic resource management and unlock the full potential of crypto finance. Stay tuned for more expert insights and analysis at Gonlat.

Visit our website to learn more: [Your Website URL]

Stay up-to-date with the latest news and trends: [Your Social Media Handles]

just found this channel on youtube and I’m OBSESSED! finally someone explaining crypto in a way that makes sense to me, thanks so much for breaking it down!

omg I just watched this vid from linkedin and I’m so stoked! I had no idea about these new crypto investing strategies! I’ve been reading all day since that vid dropped and I feel like I’ve got a whole new game plan for my finances

omg I just watched your latest vid on crypto and it completely changed my mind about investing!! I was skeptical at first but you broke it down in such a clear way, now I’m considering putting some of my savings into it. Thanks for sharing your knowledge!

just watched your latest vid on crypto and I’m HOOKED!! been doing some research on my own but this is the first time I’ve seen anyone explain it in a way that makes sense to me, thanks for breaking it down!