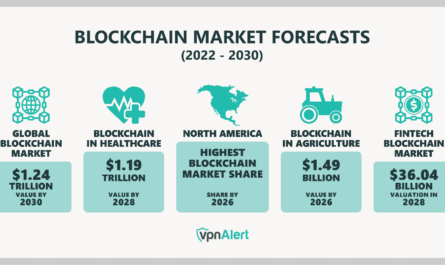

At Gonlat, we believe that the future of finance is blockchain-based. As the crypto landscape continues to evolve, it’s essential to stay ahead of the curve with expert guidance on crypto finance, investments, and financial education. In this blog post, we’ll delve into the world of cryptocurrency, exploring innovative strategies, proven techniques, and real-world case studies to optimize economic resource management.

Crypto Finance 101: Understanding the Basics

Before diving into advanced topics, it’s crucial to grasp the fundamental concepts of crypto finance. This includes understanding the differences between various types of cryptocurrencies (e.g., Bitcoin, Ethereum), blockchain technology, and the role of cryptocurrency exchanges.

Did you know that the total market capitalization of all cryptocurrencies has surpassed $2 trillion? The potential for growth is vast, but it’s essential to approach crypto investments with caution and a clear understanding of the risks involved.

Case Study: Optimizing Crypto Portfolio Diversification

One successful strategy for optimizing crypto portfolio diversification is to allocate assets across different asset classes, such as:

1. Large-cap cryptocurrencies: Bitcoin (BTC) and Ethereum (ETH)

2. Mid-cap cryptocurrencies: Litecoin (LTC) and Monero (XMR)

3. Small-cap cryptocurrencies: EOS and Tezos

By spreading investments across these categories, investors can reduce risk and increase potential returns.

Innovative Advice: Leveraging DeFi and NFTs

Decentralized finance (DeFi) and non-fungible tokens (NFTs) are two emerging trends in the crypto space that offer exciting opportunities for savvy investors. Here’s how to get started:

1. DeFi: Explore decentralized lending platforms like MakerDAO, Compound, or Aave.

2. NFTs: Invest in digital art marketplaces like SuperRare, Rarible, or OpenSea.

These emerging assets can provide significant returns, but it’s essential to conduct thorough research and understand the underlying mechanics before investing.

Practical Examples: Putting Crypto Financial Education into Practice

At Gonlat, we believe that hands-on experience is essential for mastering crypto finance. Here are some practical examples:

1. Crypto Trading Platforms: Use platforms like Binance, Kraken, or Huobi to practice trading and monitor market trends.

2. Cryptocurrency Research Tools: Utilize resources like CoinMarketCap, CryptoSlate, or NerdWallet to stay informed about market news and analysis.

Conclusion: Unlocking the Power of Crypto Finance

At Gonlat, we’re committed to empowering individuals with the knowledge and expertise needed to thrive in the crypto finance space. By understanding the basics of crypto finance, leveraging innovative strategies like DeFi and NFTs, and putting practical examples into practice, investors can optimize their economic resource management and unlock new opportunities for growth.

Stay ahead of the curve with Gonlat’s expert insights on crypto finance. Join our community today and discover a world of limitless possibilities in the realm of cryptocurrency.

OMG this is exactly what I needed to know about tax implications for crypto!! I’ve been trying to figure that out myself and it’s so confusing. Your explanation made total sense, thank you so much for breaking it down like that!