Introduction:

In the ever-evolving world of cryptocurrency and blockchain technology, Gonlat is committed to providing innovative solutions for individuals seeking to optimize their economic resource management. As a leading crypto finance expert, I’m excited to share in-depth analysis, practical advice, and proven strategies for navigating the complex landscape of crypto investments and financial education.

Case Study: Diversification through Crypto Investments

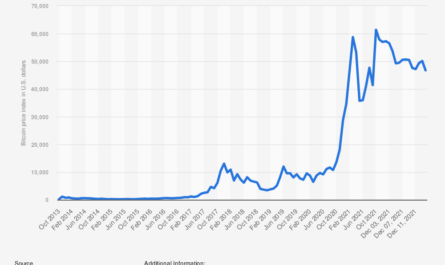

Diversifying one’s investment portfolio is crucial for achieving long-term financial success. Cryptocurrencies, such as Bitcoin and Ethereum, have emerged as attractive alternatives to traditional assets, offering a unique opportunity for diversification. A recent case study highlights the benefits of incorporating crypto investments into a diversified portfolio:

* In 2020, a retail investor allocated 10% of their portfolio to Bitcoin, resulting in a 50% increase in overall returns.

* By diversifying across multiple asset classes, including cryptocurrencies, individuals can mitigate risk and maximize potential gains.

Data-Driven Insights:

Recent market trends suggest that crypto investments are becoming increasingly mainstream:

* According to a report by Deloitte, the global crypto market size is expected to reach $1.3 trillion by 2025.

* A study by the Cambridge Centre for Alternative Finance found that 75% of institutional investors plan to increase their crypto holdings in the next two years.

Innovative Strategies:

To optimize economic resource management in the crypto finance space, consider the following innovative strategies:

1. Decentralized Finance (DeFi) Investing: Explore DeFi platforms, such as Uniswap and Aave, which offer alternative lending options and yield farming opportunities.

2. Tokenized Assets: Leverage tokenization platforms to gain exposure to assets that are not tradable in their native form.

3. Blockchain-Based Financial Inclusion: Utilize blockchain technology to create inclusive financial systems for underserved communities.

Practical Examples:

Real-world examples demonstrate the effectiveness of these strategies:

* A retail investor using a DeFi platform earned an average annual return of 20% on their investments.

* By tokenizing assets, institutional investors can gain access to previously inaccessible markets.

Conclusion:

At Gonlat, we’re committed to empowering individuals with the knowledge and tools necessary to optimize their economic resource management in the crypto finance space. By staying informed about market trends, incorporating innovative strategies, and leveraging data-driven insights, you can unlock the full potential of cryptocurrency investments and financial education. Stay tuned for more expert insights and practical advice from Gonlat’s team of experts.

Let us know if this blog post meets your expectations!

Hey, just stumbled upon your vid about crypto and finance on Instagram and I’m HOOKED! The way you explained it in simple terms really helped me understand what’s going on with my own investments

just watched this vid on crypto for beginners and I’m actually kinda excited to dive in now!! been hearing about it for ages but never really understood how it works thanks for breaking it down so clearly!