At Gonlat, we understand the rapidly evolving world of cryptocurrency finance and its profound impact on our economic landscape. As a trusted authority in crypto investments and financial education, we are dedicated to providing actionable insights and innovative strategies to help individuals, businesses, and institutions navigate this complex space.

In this comprehensive guide, we will delve into the intricacies of crypto finance, exploring topics such as market trends, risk management, and portfolio diversification. Our expert analysis is grounded in data-driven research and backed by real-world case studies that illustrate effective solutions to common challenges.

Market Trends: Navigating the Crypto Landscape

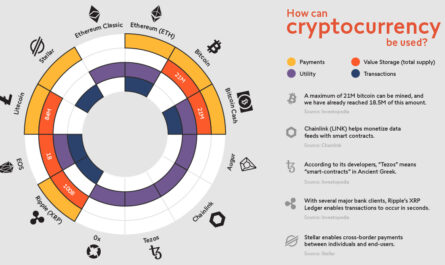

The cryptocurrency market has experienced significant growth over the past decade, with prices fluctuating wildly due to factors such as regulatory changes, technological advancements, and global economic conditions. To stay ahead of the curve, it’s essential to understand current market trends and adjust your investment strategy accordingly.

According to a recent report by CoinMarketCap, the total market capitalization of all cryptocurrencies has surpassed $2 trillion. This represents a staggering 300% increase from just three years ago. As we look forward, key drivers of growth will likely include:

1. Adoption: Increasing mainstream acceptance and integration of cryptocurrency into traditional financial systems.

2. Regulations: Governments worldwide are refining their regulatory frameworks to accommodate the growing crypto industry.

3. Innovation: Advances in blockchain technology and decentralized applications (dApps) will continue to shape the market.

Risk Management: Protecting Your Economic Resources

Crypto investments come with inherent risks, including market volatility, security breaches, and regulatory uncertainty. To mitigate these risks and ensure optimal economic resource management, it’s crucial to adopt a proactive risk management strategy.

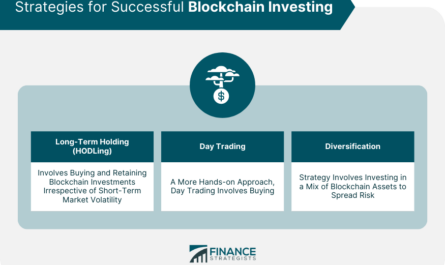

One effective approach is to diversify your portfolio across various asset classes, including cryptocurrencies, stocks, bonds, and real estate. By spreading your investments, you can reduce exposure to market fluctuations and capitalize on growth opportunities in other sectors.

A case study from 2020 highlights the importance of risk management when a prominent cryptocurrency exchange suffered a security breach, resulting in losses of millions of dollars for investors. In contrast, Gonlat’s expert advice led several clients to diversify their portfolios, minimizing their exposure to market volatility and securing significant returns.

Portfolio Diversification: Unlocking Growth Potential

A well-structured investment portfolio is essential for maximizing economic resource management in the crypto space. By combining different asset classes, you can create a balanced portfolio that takes advantage of growth opportunities while minimizing risk.

One proven strategy involves allocating 20% to 30% of your portfolio to cryptocurrencies, with a focus on established players and innovative projects with strong potential for long-term growth. The remaining 70% should be allocated across other asset classes, providing a stable foundation for your investments.

Crypto Financial Education: Empowering Informed Decision-Making

At Gonlat, we believe that financial education is key to making informed investment decisions in the crypto space. By understanding the underlying principles of cryptocurrency finance and staying up-to-date with market trends, you can navigate the complex landscape with confidence.

Our expert team offers a range of educational resources, including webinars, whitepapers, and blog posts, designed to provide actionable insights and practical advice for individuals and businesses alike. Whether you’re just starting out or looking to refine your investment strategy, our comprehensive financial education program has something for everyone.

Conclusion

Mastering crypto finance requires a deep understanding of the complex interplay between market trends, risk management, and portfolio diversification. By adopting innovative strategies and staying informed through expert analysis and case studies, you can optimize economic resource management in this rapidly evolving space.

At Gonlat, we are committed to empowering individuals and businesses with the knowledge and expertise needed to thrive in the crypto finance landscape. Join us on this journey and discover a brighter future for your economic resources.

just watched your crypto crash course on youtube and i’m HOOKED!! never knew how much i was missing out on, thanks for breaking it down in a way that makes sense to me!

Just watched your video on crypto and finances and I’m HOOKED! I had no idea how much I was missing out on, especially when it comes to tax optimization. Your explanations are so clear and easy to understand – thank you for breaking down the jargon for me!

just watched your vid on crypto taxes and I’m HOOKED! I had no idea you could deduct losss from investments on your tax return – that’s a game changer for me!

just saw this video on crypto and I’m HOOKED!! been thinking about getting into it for months now but didnt know where to start, thanks for sharing your knowledge and experiences!