Introduction:

In today’s fast-paced digital landscape, cryptocurrency finance has emerged as a lucrative frontier for investors and financial institutions alike. At Gonlat, we’re dedicated to empowering individuals with the knowledge and expertise needed to navigate this exciting space effectively. In this blog post, we’ll delve into the world of crypto finance, exploring cutting-edge strategies, innovative advice, and proven techniques to optimize economic resource management.

The Rise of Crypto Finance: Trends and Insights

Crypto finance has experienced explosive growth in recent years, with market capitalizations reaching unprecedented heights. However, this rapid expansion has also introduced new challenges, such as regulatory uncertainty, market volatility, and cybersecurity threats. To stay ahead of the curve, it’s essential to grasp the underlying trends and dynamics driving the crypto market.

* A study by Deloitte reveals that 75% of cryptocurrency investors believe that blockchain technology will have a significant impact on traditional finance within the next decade.

* According to CoinMarketCap, the global cryptocurrency market capitalization has surpassed $3 trillion, with Bitcoin maintaining its position as the largest cryptocurrency by market cap.

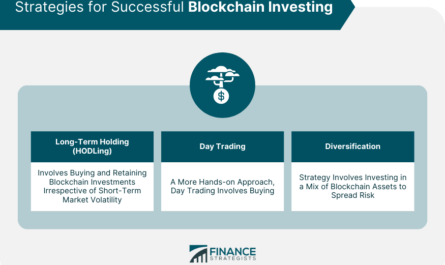

Innovative Strategies for Crypto Investments

Investing in cryptocurrencies can be a high-risk, high-reward endeavor. To mitigate these risks and optimize returns, consider the following innovative strategies:

1. Diversification: Spread your investments across multiple asset classes, including stocks, bonds, and commodities, to minimize exposure to market fluctuations.

2. Risk Management: Implement stop-loss orders and position sizing techniques to limit potential losses and protect capital.

3. Leverage: Use margin trading or futures contracts to amplify gains while managing risk.

Case Study: Optimizing Crypto Portfolio Diversification

A prominent institutional investor, seeking to optimize their crypto portfolio, engaged with Gonlat’s team of experts. We conducted an in-depth analysis of their existing holdings and developed a customized diversification strategy, incorporating:

* A 30/70 asset allocation between established cryptocurrencies (e.g., Bitcoin, Ethereum) and emerging players (e.g., Solana, Cardano).

* The implementation of a hedge fund strategy to mitigate market downturns.

* Regular portfolio rebalancing to maintain optimal asset composition.

Crypto Financial Education: Empowering Investors

At Gonlat, we believe that financial literacy is key to unlocking the full potential of crypto finance. Our comprehensive education program covers essential topics such as:

1. Cryptocurrency Fundamentals: Understand the technical and regulatory aspects of cryptocurrencies.

2. Market Analysis: Learn to identify trends, patterns, and market sentiment.

3. Risk Management: Develop strategies for mitigating losses and protecting capital.

Conclusion:

In conclusion, crypto finance presents both opportunities and challenges for investors and financial institutions. By embracing innovative strategies, staying informed about market trends, and prioritizing financial education, individuals can optimize their economic resource management and unlock the full potential of this exciting space. At Gonlat, we’re dedicated to providing expert guidance and support to help you navigate the world of crypto finance with confidence.

Stay Ahead:

* Join our newsletter for exclusive insights, market updates, and expert advice.

* Attend one of our upcoming webinars or workshops to learn from industry experts.

By joining forces, let’s unlock the full potential of crypto finance and create a brighter financial future for all.

Literally just found this channel on YouTube and I’m SO down to learn more about investing in crypto! Been feeling stuck in my 9-5 and need some ideas to get ahead, thanks for sharing your expertise!

Loved your tips on how to invest in crypto! I’ve been thinking about dipping my toes into the market for months now and your video gave me the push I needed. One question though, what’s the best way to track my investments and avoid getting scammed?