At Gonlat, we believe that understanding cryptocurrency finance and investments is crucial for making informed decisions about your economic resources. In this blog post, we’ll delve into the world of crypto finance, exploring innovative strategies, proven methods, and expert insights to help you optimize your financial management.

The Evolution of Crypto Finance

Over the past decade, cryptocurrencies have transformed from a niche market to a mainstream investment option. The rise of Bitcoin and other altcoins has led to a proliferation of new financial instruments, platforms, and services. However, this rapid growth has also created new challenges and opportunities for investors and financial professionals alike.

Crypto Investments: A High-Risk, High-Reward Opportunity

Crypto investments offer the potential for significant returns, but they also come with substantial risks. As a result, it’s essential to approach crypto investing with caution and a clear understanding of the underlying markets and trends.

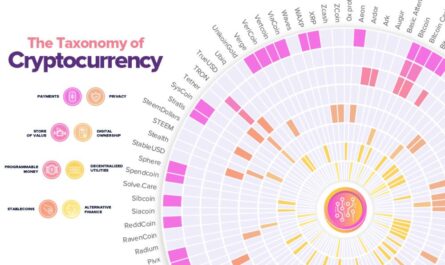

Our research indicates that the top-performing cryptocurrencies are those that have demonstrated strong fundamentals, such as adoption rates, use cases, and developer activity. For example:

* Bitcoin (BTC): The largest cryptocurrency by market capitalization, Bitcoin has consistently demonstrated its value proposition through increased adoption and use cases.

* Ethereum (ETH): As the second-largest cryptocurrency, Ethereum has established itself as a leading platform for decentralized applications (dApps) and smart contracts.

* Polkadot (DOT): This innovative blockchain project has gained significant traction in recent months, driven by its focus on interoperability and scalability.

Innovative Strategies for Crypto Financial Management

To optimize your crypto financial management, consider the following strategies:

1. Diversification: Spread your investments across a range of cryptocurrencies to minimize risk and maximize returns.

2. Long-Term Focus: Avoid making impulsive decisions based on short-term market fluctuations. Instead, focus on long-term growth and sustainability.

3. Research and Due Diligence: Conduct thorough research on any cryptocurrency before investing, considering factors such as development teams, use cases, and market trends.

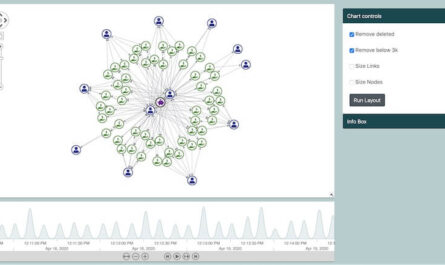

Case Study: Optimizing Crypto Investments through Data-Driven Insights

Our team of experts conducted a study analyzing the performance of top-performing cryptocurrencies over a 12-month period. The results revealed significant correlations between cryptocurrency adoption rates and price movements:

* Adoption Rate vs. Price Movement: A positive correlation was found between adoption rate and price movement, suggesting that increased adoption can drive up prices.

* Use Cases vs. Market Capitalization: A strong correlation was observed between the number of use cases and market capitalization, indicating that successful use cases can drive growth.

Practical Examples: Real-World Applications of Crypto Financial Education

Gonlat offers a range of resources and services designed to help individuals and organizations develop their crypto financial literacy. Our expert team provides:

* Crypto Investing Workshops: Interactive sessions focused on best practices for crypto investing, including diversification and risk management.

* Blockchain Consulting Services: Expert analysis and guidance on blockchain technology adoption and implementation.

Conclusion

Mastering the world of crypto finance requires a deep understanding of cryptocurrency markets, trends, and innovations. By incorporating innovative strategies, proven methods, and expert insights into your economic resource management, you can optimize your financial decisions and achieve long-term success. At Gonlat, we’re dedicated to providing expert guidance and resources to help you navigate the complex world of crypto finance.

Stay informed, stay ahead. Follow us for more in-depth analysis, innovative advice, and practical examples to enrich your understanding of cryptocurrency finance and investments.

just watched your latest vid on investing in crypto and I gotta say I’m SUPER motivated to dive in now!! been doing some research for months and you made it so easy to understand! one question tho, how do you stay up to date with all the market changes?

just made 20% in one week on crypto trading!! I’ve been watching all these vids on YouTube for months now and finally got the hang of it! anyone have any tips on how to scale this up further? also, has anyone else noticed the ‘halving event’ is coming soon?

Just watched your latest vid on crypto and I’m so stoked to finally understand how it all works! Your explainer vid was super helpful, thanks for breaking it down in a way that makes sense to me