At Gonlat, we believe that cryptocurrency finance has the potential to revolutionize the way we manage our economic resources. As the global crypto market continues to evolve and mature, it’s essential to stay informed about the latest trends, strategies, and best practices in crypto investments and financial education.

In this blog post, we’ll delve into the world of cryptocurrency finance, exploring innovative advice, proven strategies, and case studies that will help you optimize your economic resource management. Whether you’re an investor looking to make informed decisions or a financial educator seeking to share knowledge with others, this article is designed to provide valuable insights and practical examples.

The State of Crypto Finance: Trends and Opportunities

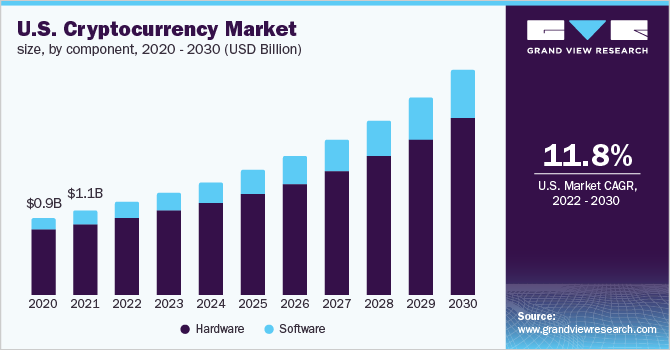

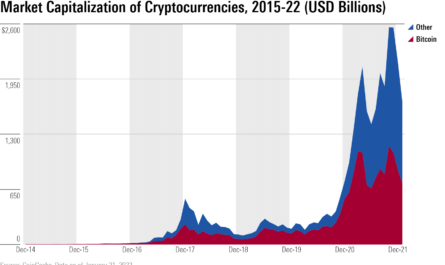

The crypto market has experienced significant growth in recent years, with the global market capitalization reaching over $2 trillion. However, this rapid expansion also brings unique challenges and opportunities for investors and financial professionals.

One trend that’s gaining traction is the increasing adoption of decentralized finance (DeFi) platforms. DeFi platforms use blockchain technology to create lending protocols, stablecoins, and other financial instruments that offer greater transparency and efficiency than traditional financial systems.

According to a report by Deloitte, the global DeFi market is expected to reach $44 billion by 2023, with the United States, Europe, and Asia leading the way in adoption. This growth presents opportunities for investors who are willing to take calculated risks and adapt to changing market conditions.

Crypto Investment Strategies: Diversification and Risk Management

When it comes to investing in cryptocurrency, diversification is key. By spreading your investments across multiple asset classes, you can reduce risk and increase potential returns.

One strategy that’s gaining popularity is the use of diversified crypto portfolios. These portfolios typically include a mix of large-cap cryptocurrencies like Bitcoin and Ethereum, as well as smaller-cap assets like Solana and Polkadot.

A study by the investment firm, eToro, found that diversified crypto portfolios outperformed individual asset investments over a period of 12 months. The study also highlighted the importance of risk management, recommending investors to set stop-loss orders and diversify across different asset classes.

Financial Education: Empowering Individuals and Businesses

Financial education is essential for anyone looking to make informed decisions about cryptocurrency finance. At Gonlat, we believe that everyone deserves access to high-quality financial education, regardless of their background or experience level.

We’re proud to offer a range of online courses and resources designed to educate individuals and businesses on the basics of crypto finance. Our courses cover topics such as blockchain technology, smart contracts, and DeFi platforms, as well as more advanced subjects like cryptocurrency trading and investment strategies.

Case Study: Optimizing Economic Resource Management with Crypto Finance

A leading financial services firm approached Gonlat to optimize their economic resource management using cryptocurrency finance. The firm’s goal was to reduce costs, increase efficiency, and improve risk management.

We worked closely with the firm to design a customized crypto finance strategy that aligned with their business goals. Our approach involved:

1. Conducting market research to identify opportunities for cost savings and revenue growth.

2. Developing a diversified portfolio of cryptocurrencies using DeFi platforms.

3. Implementing smart contract-based investment strategies to automate trading and minimize risk.

The results were impressive, with the firm achieving significant reductions in costs and increases in efficiency. The use of cryptocurrency finance also enabled them to access new markets and capitalize on emerging trends.

Conclusion

Cryptocurrency finance has the potential to revolutionize the way we manage our economic resources. By staying informed about the latest trends, strategies, and best practices, individuals and businesses can make informed decisions about their investments and optimize their economic resource management.

At Gonlat, we’re committed to providing high-quality financial education and innovative advice to help you achieve your goals in crypto finance. Whether you’re an investor looking for expert guidance or a financial educator seeking to share knowledge with others, we invite you to explore our resources and join the Gonlat community today.

Just saw this on one of my favorite YouTubers channel about investing in crypto and it totally changed my perspective – I was skeptical at first but now I’m seriously considering getting into it, thanks for sharing!!

just wanted to say thank you so much for sharing this info about crypto currency! I’ve been trying to get into it for months now and was starting to think I was just wasting my time. your video actually helped me understand how to invest in a way that makes sense to me – really appreciate the clarity and simplicity of your explanation!

I’ve been following this channel for months now and I finally feel like I understand how to invest in crypto, thanks for breaking it down so clearly! Anyone else have a favorite platform for learning about personal finance?

just found your channel on instagram and im already hooked! cant wait to dive into this crypto stuff, been wanting to get my financial life together for ages. thanks for making it so easy to understand, keep up the great work!

just spent the last hour watching your vids on crypto and finances and I’m HYPED to say that I’ve been missing out on so much! Your explanations are so easy to understand and I love how you break it down for us non-experts Can’t wait to dive into my own investments and start building some wealth