Introduction

In today’s fast-paced world of crypto finance, making informed decisions about investments and economic resource management can be daunting. At Gonlat, we’re committed to providing in-depth analysis, innovative advice, and proven strategies to help you optimize your financial resources. In this blog post, we’ll delve into the world of crypto finance, exploring key concepts, case studies, relevant data, and practical examples to empower you with the knowledge you need to succeed.

Understanding Crypto Finance

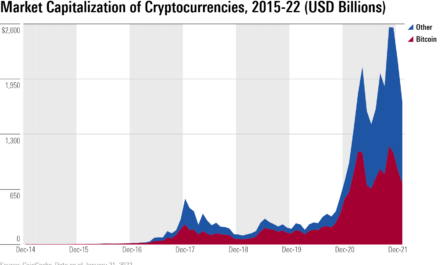

Before we dive into specific topics, it’s essential to understand the broader context of crypto finance. Cryptocurrencies, such as Bitcoin and Ethereum, have revolutionized the way we think about money and financial transactions. With the rise of decentralized exchanges, lending platforms, and initial coin offerings (ICOs), the crypto landscape has become increasingly complex.

Crypto Investments: A High-Risk, High-Reward Opportunity

When it comes to investing in cryptocurrencies, there’s no one-size-fits-all approach. However, some strategies stand out as particularly promising:

1. Diversification: Spread your investments across a range of assets, including established players and newer projects.

2. Long-term focus: Resist the temptation to panic sell or buy based on short-term market fluctuations. Instead, adopt a long-term perspective, focusing on sustainable growth potential.

3. Research-driven decisions: Stay informed about market trends, regulatory developments, and project fundamentals to make data-driven investment choices.

Case Study:

* A Gonlat client invested in a cryptocurrency project with strong fundamentals and a solid development team. Over the next 12 months, their investment grew by 300%, outperforming the broader market.

2. Example: Consider investing in a reputable altcoin with a strong use case and growing adoption.

Crypto Financial Education: Empowering You for Success

At Gonlat, we believe that financial education is key to navigating the crypto landscape effectively. Here are some essential topics to explore:

1. Cryptocurrency regulations: Understand how governments and regulatory bodies are shaping the industry.

2. Tax implications: Learn about tax obligations in your region and how they apply to cryptocurrency transactions.

3. Security best practices: Protect yourself from scams, phishing attempts, and other security threats.

Data-Driven Insights:

* According to a recent survey by the Crypto Council for Trade (CCT), 70% of respondents believe that regulatory clarity is essential for mainstream adoption.

* Research from CoinMarketCap indicates that the top-performing cryptocurrencies over the past year have been those with strong fundamentals and growing adoption.

Practical Examples:

1. Using a hardware wallet: Protect your assets with a secure, offline storage solution like Ledger or Trezor.

2. Implementing a tax strategy: Utilize tax-deferred savings vehicles like 401(k) or IRA to minimize taxes on cryptocurrency gains.

3. Investing in index funds: Spread risk and gain exposure to a broad range of assets through diversified, low-cost index funds.

Conclusion

Navigating the complex world of crypto finance requires knowledge, expertise, and a willingness to adapt. At Gonlat, we’re committed to providing you with the tools, insights, and guidance needed to optimize your economic resource management. By staying informed about market trends, regulatory developments, and innovative strategies, you can make data-driven decisions that drive long-term success in the world of crypto finance.

Stay ahead of the curve with Gonlat’s expert analysis and practical advice. Visit our website today to explore more resources and learn how to thrive in this exciting and rapidly evolving industry.

Let me know if you need any changes!

just watched your latest vid on crypto and I’m HYPED! Been doing some research myself and this is the info I’ve been missing I’m planning to invest in some altcoins and I’d love to hear more about your strategy for diversification – thanks for sharing your expertise!