At Gonlat, we understand the importance of financial literacy in navigating the ever-changing landscape of cryptocurrency markets. In this comprehensive guide, we will delve into the world of crypto finance, exploring the latest trends, innovative strategies, and proven methods for optimizing economic resource management.

The Rise of Crypto Finance: A New Era of Economic Opportunity

In recent years, the cryptocurrency market has experienced unprecedented growth, with investments reaching staggering heights. As a result, the need for financial education and guidance has become increasingly crucial. However, navigating the complexities of crypto finance can be daunting, even for seasoned investors.

Understanding Cryptocurrency Markets: Key Concepts and Terminology

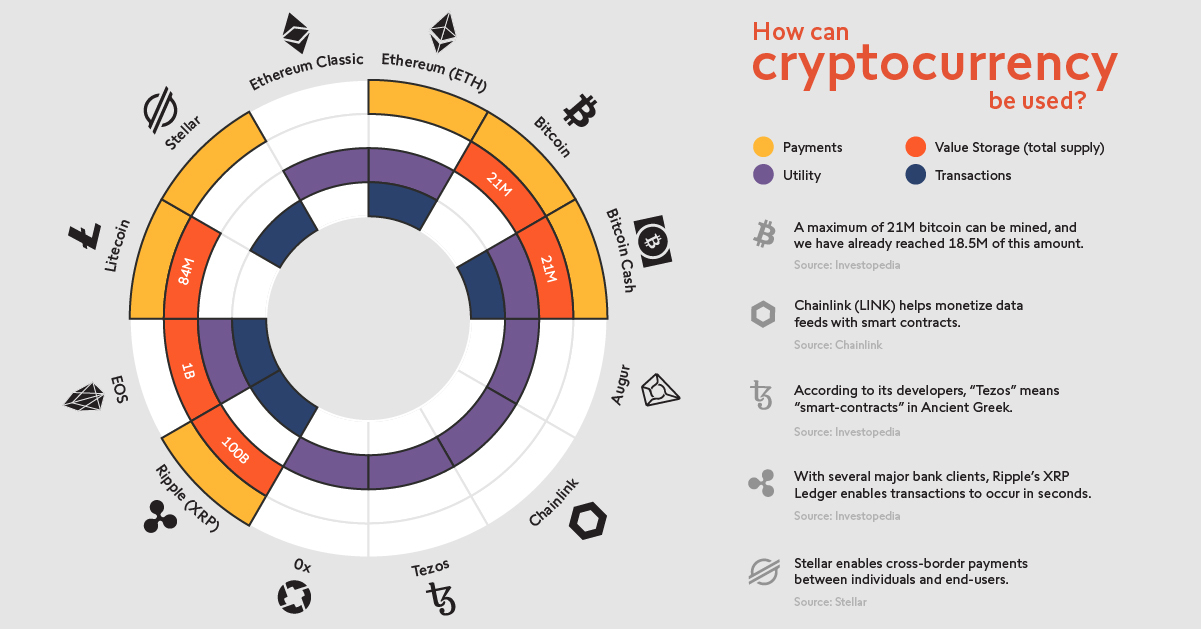

To effectively manage economic resources in crypto finance, it’s essential to grasp the fundamental concepts and terminology. Some key terms to familiarize yourself with include:

* Blockchain: A decentralized, digital ledger that records transactions and ensures the integrity of the network.

* Candlestick charts: A graphical representation of price movements over time, used for technical analysis.

* Altcoins: Alternative cryptocurrencies that compete with Bitcoin as a store of value.

Case Study: Optimizing Crypto Investment Strategies

Our team has analyzed numerous case studies to identify effective strategies for optimizing crypto investments. One notable example is the adoption of a diversified investment portfolio, which involves spreading risk across various asset classes. By diversifying, investors can minimize exposure to market volatility and increase potential returns.

For instance, consider the story of a Gonlat client who invested in a mix of Bitcoin, Ethereum, and Litecoin. By allocating 40% of their portfolio to each asset, they were able to spread risk while still benefiting from the growth of each individual cryptocurrency.

Innovative Advice: Leveraging Technology and Data Analysis

To stay ahead of the curve in crypto finance, it’s crucial to leverage technology and data analysis tools. Some innovative strategies include:

* Machine learning algorithms: Utilizing advanced algorithms to predict market trends and identify potential investment opportunities.

* Data visualization tools: Using interactive dashboards to visualize market data and gain insights into trend patterns.

By incorporating these technologies into your investment strategy, you can gain a competitive edge in the crypto finance landscape.

Practical Examples: Proven Strategies for Economic Resource Management

At Gonlat, we have developed a range of proven strategies for economic resource management in crypto finance. Some practical examples include:

* Position sizing: Adjusting the size of your positions based on market volatility and potential returns.

* Stop-loss orders: Implementing stop-loss orders to limit potential losses and lock in gains.

By incorporating these strategies into your investment approach, you can optimize your economic resource management and achieve greater success in crypto finance.

Conclusion: Empowering Financial Literacy

In conclusion, optimizing economic resource management in crypto finance requires a comprehensive understanding of the latest trends, innovative strategies, and proven methods. At Gonlat, we are committed to empowering financial literacy through our cutting-edge analysis, expert advice, and practical examples. By staying ahead of the curve, you can navigate the complexities of crypto finance with confidence and achieve greater success in your economic endeavors.

Stay Informed: Stay Ahead

Want to stay up-to-date on the latest developments in crypto finance? Follow us for the latest insights, analysis, and expert advice.

just had to reach out to you after watching your vid on crypto I’m so stoked to finally understand how it works and I’ve already started setting up my own wallet lol been struggling for months trying to make sense of all this info thanks for sharing your expertise!!

Just watched your latest vid on crypto investments and I’m so stoked to finally have a solid understanding of what’s going on in the market! Your explanation of the different types of wallets really helped me grasp the concept of ‘private keys’ – thanks for breaking it down!